-

BEQUEST AND SUCCESSION

At least once in a lifetime everyone has something to do with succession – either wishing to make a will or having become an heir.

Usually, people turn to a notary in order to leave someone an apartment, a registered immovable, a vehicle etc. However, if such a wish is written in the will, it is not clear, what the testator actually wanted, for the will can be interpreted in different ways: did the testator wish to nominate a successor and list the essential part of the property in the will, or have someone nominated as successor and leave another person only one specific item, or else the testator wanted to make the persons listed in the will (i.e., if there are several persons) successors, and have them divide the estate in a manner set out in the will.

If you wish to make a will or have other questions concerning succession, it is best to turn to a notary. You can pick any notary to make a will and sort out matters related to inheritance. The contact data of Estonian notaries are listed on the homepage of the Chamber of Notaries: Notarid.

TERMS RELATED TO SUCCESSION

- Bequeather

A bequeather is a person whose property transfers upon his or her death to another person.

A bequeather is also a person who makes a disposition of his or her estate in the event of his or her death and in the Estonian Law of Succession Act the term used in this case is “the testator”.

- Opening of succession

A succession opens upon the death of a person, and the time of opening of a succession is the date of death of the bequeather. The place of opening of a succession is the last residence of the bequeather.

This means that succession has (automatically) opened as of the date of death and the property (estate) that belonged to the bequeather transfers to the successor as of the same date, and the successor is identified in the course of the succession proceedings conducted by a notary.

Thus, the estate transfers to the successor retroactively, as of the date of death of the bequeather.

- Estate

An estate is the property of a bequeather, i.e., all his or her things, as well as the rights and obligations that are not inseparably bound to the person of the bequeather.

In addition to registered immovable property, vehicles, money in the bank, personal objects etc., belonging to the bequeather, the estate also includes unpaid loans, debts to an apartment association, instalment payments due and unpaid, as well as other obligations.

The estate does not include rights and obligations that are inseparably bound to the person of the bequeather, e.g., pecuniary punishments and fines connected with assets, membership in a non-profit association, income tax benefits, employment contract in the event the deceased was working, authorship of works etc.

If the law provides that a right or obligation ends with the death of a person, it is inseparably bound to the person.

In case a bequeather was married and the spouses used a joint property regime, then upon the death of one spouse the share of this spouse in the joint property becomes part of his or her estate irrespective of which spouse acquired the property or in whose name it was registered (more information about the proprietary relations of spouses can be found here: https://www.notar.ee/et/teabekeskus/perekond). Thus, the estate could also include a part of the money in the bank account of the spouse of the bequeather (surviving spouse), as well as part of the vehicle or immovable registered in the name of the surviving spouse etc. Also, property registered in the name of the bequeather need not necessarily be fully part of the estate if it was held by the spouses as joint property.

- Successor

A successor is the person to whom all the property of the bequeather transfers. According to Estonian legislation it is not possible to directly leave individual objects to a person. In case there are several successors, the whole estate (all objects, rights, obligations included in the estate) becomes their joint ownership (community of estate) and the successors have the right to divide the estate.

A testate successor is a person to whom a testator bequeaths by a will all his or her property or a legal share (fraction) thereof. There is no need to list the property in a will. Such a list of property in the will may even cause misunderstanding, should the composition of property change over time. The successor gets what belongs to the bequeather on the day of his or her death, wherever the property is located.

If the bequeather has not specified a successor in a will, intestate successors, i.e., the bequeather’s spouse and relatives inherit the estate. The spouse is a successor irrespective of the proprietary relations between the spouses.

Relatives succeed in three orders, as follows: if there is at least one first order successor, the second order successors do not succeed; if there are no first order successors, the second order successors succeed, and the third order successors succeed only if there are no second order successors. The spouse succeeds together with the first order and second order successors. The spouse is the sole successor if there are no relatives of first or second order.

First order successors are the descendants of a bequeather – first and foremost his or her children. If the child is deceased or has renounced succession and the child has children of his or her own, these children inherit the part to which the parent who is deceased or who has renounced succession would have had the right.

Example: The bequeather had two children – a daughter and a son, but the son had died before the bequeather. Both children have two children of their own. Had both children of the bequeather been alive, they would have succeeded in equal shares – ½ and ½. But as the son had died before the bequeather, his children succeed in equal shares to his share – ½, i.e., each shall have - ¼ and ¼.

Second order successors are the parents of the bequeather and their descendants. If both parents of the bequeather are alive, they succeed to the entire estate in equal shares – ½ and ½. If one or both parents of the bequeather is/are deceased or has/have renounced succession, and the parent has other children in addition to the bequeather, the share of the parent who is deceased or has renounced succession goes to his or her other children (the siblings of the bequeather) according to the provisions concerning first order successors.

Third order successors are the grandparents of the bequeather and their descendants. If all the grandparents are alive, they succeed to the entire estate in equal shares – ¼, ¼, ¼, ¼. If a paternal or maternal grandparent is deceased or has renounced succession, and he or she has more children than the parent of the bequeather, the children and grandchildren of the deceased grandparent succeed to his or her share according to the provisions concerning first order successors. If both paternal or maternal grandparents are deceased and they have no descendants, the grandparents on the other side, or their descendants succeed.

If the bequeather was not married, had not a single relative with the right to succeed, then the intestate successor is the rural municipality or city where the bequeather last resided.

- Legacy

If a testator does not give all his or her property or a legal share thereof to a person but gives a particular proprietary benefit without regarding the recipient of the benefit as his or her legal successor, the benefit shall be deemed to be a legacy and the recipient of the benefit shall be deemed to be a legatee. This means that the testator wishes to give a person just a specific object, not all of his or her property.

Example: The will states: „I shall leave the apartment to my son and the registered immovable to my daughter’s son.“. At the time of making the will the testator also had other property. The testator/bequeather has two children – a daughter and a son.

Given that in the will the son and the daughter’s son were not left all the testator’s property or a legal share thereof, but only the apartment and registered immovable, then generally such a will is deemed to give a legacy. In this case the successors are the intestate successors, i.e., the son and the daughter.

NB! There is a difference between a successor and a legatee: all the property of the bequeather transfers to the successor/successors, including the objects that have been given as legacy to someone else; the legatee does not automatically become owner of the object left to him or her, the successor must hand it over.

In order for the wishes of the testator to be unambiguously clear, i.e., whether he or she wants to appoint a successor or just give a legacy, the will must expressly state this. If the testator wishes to appoint a successor, the will should be formulated as follows: "I appoint as my successor(s)...". But if the testator wishes for the person identified in the will to receive only an object and not all of his or her property, the will should be worded so that the wish is unequivocally understandable, for it is not possible to leave individual items so that the person to whom they are left, becomes automatically their owner.

If a will is drawn up by a notary, the bequeather should clearly describe his or her wishes to the notary.

- Will

A will is a unilateral transaction whereby a bequeather (hereinafter testator) makes a disposition of his or her estate in the event of his or her death. A testator may revoke a will at any time by a later will or succession contract. A testator shall make a will himself or herself and with no consent required from anyone.

NB! Difference between a gift and a will:

- In case of giving a gift, the donee becomes owner of the gift immediately and the donor has no longer any say about the gift, he or she cannot prohibit its sale, use thereof as a pledge etc. Neither is it possible to demand the return of the gift without good reason.

- In case of a will, the testator can freely change it during his or her lifetime, he or she remains the owner of his or her property until death, and can freely possess, use, and dispose of it (without the consent of the successor). The estate transfers to the successor in the form which exists on the date of death of the testator.

There are two kinds of wills:

1) A notarial will is a notarially authenticated will or a will deposited with a notary.

2) A domestic will.

It is not possible to make a digitally signed will, an oral will or a video will in Estonia.

Therefore, if a testator has spoken to his or her family about who he or she would like to appoint as successor, he or she should set the intention out in a will, either at a notary or in the form of a domestic will, for without a will his or her wishes cannot be granted.

Notarial will

The term of validity of a will made with a notary (notarially authenticated will) is not limited and it remains in force until it is changed or revoked.

A notarial will can be changed or revoked by a new will or succession contract. Once a will has been revoked, the wills preceding the revoked will shall not enter into force as a rule. A notarial will can also be revoked by a domestic will, but if the domestic will becomes invalid (after six months of making the domestic will), the notarial will is valid once again.

A notary enters the data concerning the will in the succession register and appends a copy of the will to the register entry. More information about the succession register can be found here: Pärimisregister.

Information entered in the succession register can be accessed via the self-service portal of the Chamber of Notaries: Pärimisregistri teenused.

Reciprocal will of spouses

A reciprocal will of spouses is a will made jointly by the spouses in which they reciprocally nominate one another as his or her successor or make other dispositions of the estate in the event of his or her death.

Such will can only be made with a notary by spouses who have registered their marriage.

Unlike an ordinary will, it is more difficult to unilaterally revoke a reciprocal will of spouses. In order for a spouse to revoke his or her disposition, a notice must be forwarded via a notary to the other spouse. The will is deemed to be revoked when the other spouse receives the notice.

A reciprocal will of spouses becomes invalid if the marriage is divorced, the spouse has filed a claim for divorce or agreed to divorce.

Domestic will

There are two kinds of domestic wills:

1) A holographic will - the testator must write the will from beginning to end in his or her own handwriting, indicating the date and year of making the will. NB! This will may not be typed in a computer and no other person can write down the will on behalf of the testator.

2) Will signed in presence of witnesses – another person may prepare the text of the will, but the testator must sign the will in the presence of at least two witnesses with active legal capacity, who shall be present concurrently. The testator shall indicate in the will the date and year of making it.

A domestic will becomes invalid if six months have elapsed from the date of its making and the testator is alive at the time.

A testator may revoke a domestic will by a new domestic will, a notarial will, a succession contract or by destruction of the will.

The data of a domestic will can also be entered in the succession register via the state portal www.eesti.ee (EE). To do so, it is necessary to log in to the portal by using an ID-card or Mobile-ID.

If the testator is unable to enter the data himself or herself, he or she can ask someone else to help, but it is not possible to append the copy of the will to the entry. Upon becoming aware of the death of a testator, a person with whom the testator has deposited his or her will is required to submit the will promptly to a notary.

- Succession contract

Unlike a will, which the testator makes individually, a succession contract is an agreement between a bequeather and another person whereby the bequeather nominates the other party as his or her successor or gives the party a legacy, or an agreement between a bequeather and his or her intestate successor whereby the latter renounces the succession.

The bequeather can change his or her will as he or she pleases and to do so the consent of the successor is not required. However, there are limitations when it comes to unilateral amending of or withdrawal from a succession contract.

A notary enters the data concerning the succession contract in the succession register and appends a copy of the contract to the register entry.

RENUNCIATION OF SUCCESSION, ACCEPTANCE OF SUCCESSION AND TRANSFER OF ESTATE TO SUCCESSOR

It should be noted that there was a change in the law as regards renunciation of succession and starting from 2008, it is the person entitled to succeed but DOES NOT WANT to inherit, who has to submit the relevant application to a notary. i.e., it is not possible to renounce succession passively. A person who knows that he or she is entitled to but does not want to succeed, is still deemed to have accepted the succession if he or she fails to renounce succession.

The term for renunciation of succession is limited to three months – the term shall commence from the moment the successor becomes aware or ought to become aware of the death of the bequeather and of his or her right of succession. In case the successor did not know earlier about his or her right to succeed, the term shall commence from the moment a notary has sent him or her the relevant notice.

A person who is entitled to and wishes to succeed does not have to submit an application to this effect. However, to identify the successors it is necessary to turn to a notary, who then shall conduct the succession proceedings.

The decision to accept or renounce succession cannot be turned back – once the successor has accepted succession, he or she can no longer renounce it, and once the successor has renounced succession, he or she can no longer accept it.

The decision cannot be reversed even in case the successor had renounced succession thinking that the bequeather had left him or her only debts, but found out later that actually there was a lot more left in assets than in debts. The same applies to the situation where the successor thought that the bequeather was rich, but it turned out that there were considerably more debts than property. In the latter case the successor can protect himself or herself by having an inventory made of the estate.

The estate – all the rights and obligations of the bequeather – transfers to the successors who have accepted succession and they have the obligation to perform all the obligations of the bequeather. If an estate is insufficient, a successor shall perform the obligations out of the successor's own property unless the successor has, after making an inventory, performed the obligations pursuant to the procedure provided by law, the estate has been declared bankrupt or the bankruptcy proceedings have been terminated by abatement without declaring bankruptcy.

- Succession process, i.e., succession proceedings

1) Initiation of proceedings

It is necessary to turn to a notary for the identification of successors. The notary starts the proceedings upon request, not upon the notary’s own initiative.

The application to initiate succession proceedings can be submitted by a presumed successor, a creditor of the bequeather, or any other person who has good reason to learn who the successor is (e.g., a co-owner of a registered immovable).

The law does not prescribe the term during which it is necessary to turn to a notary after the death of the bequeather. However, unless the proceedings are conducted, it is not clear whether the presumed successor is truly the successor and has become owner of the estate.

The person who has the right but does not want to succeed has to hurry. He or she has to submit to a notary an application renouncing succession within three months from the moment of becoming aware of the death of the bequeather and of his or her right of succession. If the succession proceedings have not commenced yet, the application renouncing succession can be filed together with the application for initiating the succession proceedings.

Succession proceedings are conducted by one notary. Thus, if there are several successors, they cannot each go to a different notary for the proceedings.

In case it is necessary for a successor to submit any other application in the course of the proceedings, but he or she cannot approach the notary dealing with the case, he or she can go to a different notary to have the required application authenticated and forwarded to the notary conducting the proceedings.

2) Conduct of proceedings

In the course of conducting the proceedings the notary makes inquiries to the registers and credit institutions the list of which is established by a regulation of the minister, in order to establish the composition of the estate.

If the successor knows or thinks that the bequeather has taken SMS loans, has bought things on an instalment plan etc., he or she may ask the notary to make inquiries to the relevant service providers. It is also possible to make inquiries to the register of enforcement proceedings, to make sure that no enforcement proceedings have been commenced with respect to the bequeather to recover his or her debts.

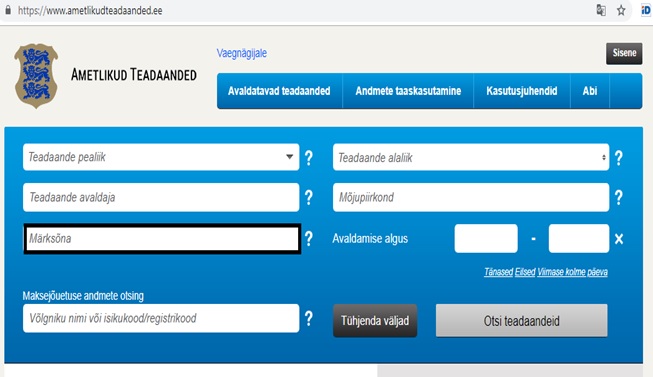

A notice about the initiation of succession proceedings is published at the following address: www.ametlikudteadaanded.ee (EE). Anyone wishing to check whether the succession proceedings concerning a person have already been initiated, can make an inquiry about it. To do so, it is necessary to enter the bequeather’s name in the field for key words; there is no need to fill in the other data fields.

The notice contains information about the notary who is conducting the proceedings, the intended deadline for authentication of the succession certificate and other data.

In addition to publishing the notice, the notary makes an entry in the succession register about initiation of the proceedings. The data entered in the succession register are accessible via the state portal www.eesti.ee (EE). More information about the succession register can be found here: https://www.notar.ee/et/registrid/parimisregister.

The notary informs the successors who were not present about the initiation of the proceedings and explains their rights and obligations concerning succession.

- Inventory of the estate

The estate transfers to a successor who has accepted succession. The estate may include various obligations that the successor has to perform. If the successor knows already before the initiation of proceedings that the bequeather had debts or learns about the debts in the course of the succession proceedings and it is not clear whether the estate would be sufficient to meet all the obligations, the successor may submit a claim for inventory to a notary. If the successor does not submit such a claim for inventory, any debts exceeding the estate must be paid by the successor out of his or her own property.

If the inventory has been conducted, the obligations related to the estate must be performed in the order prescribed by law.

In case the estate is clearly not sufficient for meeting the claims and the successor does not agree to satisfy the claims out of the successor's own property, he or she must immediately submit a petition for the declaration of bankruptcy of the estate to a court of law.

Irrespective of whether the estate includes debts or not, an inventory of the estate is obligatory, if a person with restricted active legal capacity (a minor, an adult with restricted active legal capacity), a local government or the state is a successor.

If the legal representative of a person with restricted active legal capacity (a parent of a child, a guardian provided by the court) does not request an inventory of an estate in the interest of the successor, the legal representative is personally liable for the debts of the bequeather which cannot be sufficiently satisfied from the estate.

For example, if a parent of an underaged successor thinks that the bequeather had no debts and therefore fails to submit a claim for inventory, but later it turns out that the bequeather did have debts and the value of the estate is insufficient for covering all the debts, the remainder has to be paid by the parent out of his or her property.

- Conclusion of succession proceedings

The proceedings are concluded with the identification of the successors and the notary authenticating the succession certificate to this effect. The successors can prove their right to succeed with the succession certificate.

The following shall be noted in the succession certificate: the data concerning the bequeather (name, ID-code, and date of death), the successors (name, ID-code, and address), and the share belonging to each successor (1/2, ¼, 5/16 etc.). The size of the shares noted in the succession certificate does not mean that the successors own the same proportion of each object of the estate. The estate is jointly owned by the successors, and thus they can only dispose of the estate jointly until the division of the estate.

For example, if the estate includes a registered immovable that the successors have decided to sell, they have to conclude the sales agreement all together.

- Community of the estate

A new term – community of the estate – was introduced in the Law of Succession Act, which entered into force in 2009. In essence, the term means that if several successors have accepted the succession (co-successors), the estate is owned jointly by them as the community of the estate. None of the co-successors is entitled to a share of specific items and rights forming the estate, instead, each of them is entitled to a share of the entirety of rights and obligations forming the estate.

The successors can perform transactions with the estate only jointly.

A co-successor may independently dispose of (sell, donate, pledge etc.) only the legal share in the community of the estate belonging to the co-successor, i.e., only his or share in all the property making up the community of the estate.

A transaction by which a co-successor undertakes to acquire or dispose of a share of the community of the estate or by which a co-successor disposes of the share of the community of the estate belonging to him or her shall be notarially authenticated.

Disposal of a share in the community of the estate

If several successors have accepted the succession, the estate is owned jointly by them.

Each co-successor can dispose of (sell, donate) the share in the community of the estate belonging to him or her to another co-successor or a third party. Figuratively speaking, this transaction results in dividing the succession right into two parts:

The successor maintains the title of successor but has no right to the share in the estate.

The person who acquired the share in the community of the estate participates together with the other successors in the division of the estate.

The contract for the disposal of a share in the community of the estate can only be concluded at a notary. The notary makes an entry in the succession register about the disposal of the share in the community of the estate. More information can be found here: Pärimisregister.

How to end the community of the estate?

In case the successors wish to end the community of the estate and divide the property constituting the estate between them, they have to conclude a contract for the division of the estate.

Division of the estate may be demanded by any co-successor on the condition that all successors are known. Upon division of the estate, it shall be determined which things or shares of things and which rights and obligations forming part of the estate transfer to each co-successor. If the estate includes a registered immovable, membership in a building association or a share of a private limited company, the contract for the division of the estate has to be authenticated by a notary.

- Division of the estate

Once the proceedings are completed and the successors are known, they can divide the estate and distribute the things between themselves.

The presumption is that the estate should be divided between the successors in accordance with their share in the estate, but a different agreement is not forbidden either. If the property received by each successor does not correspond to his or her share in the estate, then presumably, the successor who received a thing of higher value ought to compensate the others the part that exceeds his or her share in the estate.

For example, the estate includes a registered immovable worth 100,000 euros, an apartment worth 40,000 euros, a vehicle worth 1,000 euros and 400 euros in bank. The four children of the bequeather are the successors, each with the share of ¼ of the estate. The children have decided to divide the estate so that each gets one thing. The total value of the things making up the estate is 141,400 euros, which means that each of them should get property worth 35,350 euros (141,400x1/4). If the successors divide the things so that each gets one, then the two children who get the immovable and the apartment should pay compensation to the other two, who get the car and money in the bank. However, the successors can agree about compensation and the procedure of compensating that differ from what is provided by law.

SUCCESSION REGISTER

The succession register is an electronic register which contains information concerning succession proceedings, succession certificates, disposal of a share of the community of the estate, wills, succession contracts and estate management measures.

Everyone can access the information in the succession register concerning wills and succession proceedings connected with the person himself or herself; information concerning other persons can be accessed after their death. Information about (other) persons still living cannot be accessed in the succession register.

The data entered in the succession register are accessible free of charge via the state portal www.eesti.ee (EE). Access can be gained by using the ID-card or mobile-ID (choose the role of ‘citizen’, also when the enquiry is made by an official).

In order to make an enquiry about a bequeather (who is deceased) in the succession register take the following steps in the state portal: Home page →Legal aid →Succession and bequest →Succession →Services →Find a bequeather.

It is necessary to know the full name and ID-code of the bequeather in order to make the enquiry.

Information entered in the succession register can also be accessed via the self-service portal of the Chamber of Notaries: Pärimisregistri teenused.

The following information can be found in the succession register about the bequeather:

• Has he or she made a will;

• Have the succession proceedings been initiated;

• Have the succession proceedings been completed and who are the successors;

• Have the successors surrendered shares in the community of the estate;

• Have estate management measures been applied.

Only such data are displayed that have been entered by the time that the enquiry is made.

If an enquiry is made about a deceased person and there is no response, then probably no application has been made yet to initiate the succession proceedings.

The data about successors can be found in the register in case the succession certificate was authenticated after 2009, for pursuant to the previous Law of Succession Act it was not required to submit the information about successors. In succession cases completed earlier information about successors can be obtained from the notary who conducted the proceedings.

A FREQUENT QUESTION –DONATE OR BEQUEATH?

Notaries are often asked what is better – to make a gift or bequest. Usually this happens when people are considering whether to donate their real estate to their relatives or leave it to them in a will.

There is no good answer to this question, for a gratuitous contract leads to completely different legal consequences in comparison with a will. It is rather the legal consequences that should be kept in mind when making a decision, for the potential costs related to one or the other may not be that different.

The Law of Obligations Act regulates the conclusion of a gratuitous contract, the Law of Succession Act – bequest.

The gratuitous contract is accompanied by a real right contract, under which ownership to the object belonging to the donor transfers to the donee. For example, if a parent makes a gift of his or her apartment ownership to his or her adult child, the child becomes the owner of the apartment after the relevant entry has been made in the land register. Now the child has the right to freely dispose of the apartment ownership, i.e., sell, pledge, or donate it to a third party. It should also be taken into account that although under the Law of Obligations Act it is possible to withdraw from the gratuitous contract in certain cases, this does not mean that the ownership of the donated apartment would automatically be returned to the donor.

If the donor wishes to continue using the apartment after concluding the gratuitous contract, it would be wise to enter into a contract for personal right of use. The provisions regulating personal right of use come from the Law of Property Act. A relevant entry is made about the right in the land register and on this basis, it is possible to require that any subsequent owner allow continued use of the apartment by the donor.

In the case of a will the person remains the owner of the property until death and if necessary, can conduct transactions with the property, revoke or change the will.

Making a notarially authenticated will costs 32.55 euros and a reciprocal will of spouses 41.50 euros (plus VAT). The successors shall incur additional costs only when succession proceedings are conducted.

In the case of a gratuitous contract the notary fee depends on the value of the property given as a gift. For example, the fee for authenticating the gratuitous contract for making a gift of an apartment worth 60,000 euros is 196.20 euros, plus VAT. In addition, the state fee has to be paid for amending the entry in the land register.

Loe ja vaata lisaks

Artiklid ja infomaterjalid:

- Notari esimene ülesanne on välja selgitada pärijad (Viljandi notar Kersti Kulla artikel Äripäevas)

- Kas loobuda pärandist või valida pärandvara pankroti tee? (Viljandi notar Kersti Kulla artikkel Äripäevas)

- Kuidas pärida ja pärandada? (Tallinna notar Kristel Jänese artikkel Postimehes)

- Eakale tähtis valik – kas testament või volikiri (Tallinna notar Priidu Pärna artikkel Postimehes)